All Categories

Featured

Table of Contents

Many of those property owners didn't even understand what excess were or that they were even owed any kind of surplus funds at all. When a home owner is not able to pay residential property tax obligations on their home, they may shed their home in what is known as a tax sale public auction or a sheriff's sale.

At a tax obligation sale public auction, properties are marketed to the highest possible prospective buyer, nonetheless, sometimes, a building might sell for more than what was owed to the county, which causes what are referred to as surplus funds or tax obligation sale excess. Tax obligation sale overages are the additional cash left over when a foreclosed home is cost a tax obligation sale auction for more than the quantity of back tax obligations owed on the residential property.

If the residential property markets for greater than the opening proposal, after that overages will certainly be produced. However, what many property owners do not know is that several states do not enable regions to keep this money on their own. Some state statutes determine that excess funds can only be asserted by a few parties - including the individual who owed tax obligations on the residential or commercial property at the time of the sale.

If the previous building proprietor owes $1,000.00 in back tax obligations, and the property costs $100,000.00 at public auction, after that the law states that the previous building proprietor is owed the distinction of $99,000.00. The county does not reach keep unclaimed tax obligation excess unless the funds are still not asserted after 5 years.

Reputable Bob Diamond Tax Overages Blueprint Training Overages List By County

The notification will usually be sent by mail to the address of the property that was marketed, but considering that the previous residential property owner no much longer lives at that address, they usually do not receive this notice unless their mail was being forwarded. If you remain in this situation, don't let the federal government maintain cash that you are qualified to.

Every now and then, I listen to discuss a "secret brand-new opportunity" in business of (a.k.a, "excess earnings," "overbids," "tax sale excess," etc). If you're completely not familiar with this principle, I want to offer you a fast introduction of what's going on here. When a building proprietor stops paying their real estate tax, the regional community (i.e., the county) will certainly wait on a time before they confiscate the property in repossession and sell it at their yearly tax obligation sale public auction.

The info in this article can be impacted by many special variables. Intend you possess a residential property worth $100,000.

Overages List By County Best States For Tax Overages

At the time of repossession, you owe ready to the area. A few months later on, the county brings this property to their annual tax sale. Here, they market your home (together with loads of various other overdue homes) to the highest bidderall to redeem their shed tax obligation earnings on each parcel.

Most of the capitalists bidding on your residential property are completely mindful of this, also. In several cases, residential or commercial properties like yours will certainly get quotes FAR past the amount of back tax obligations actually owed.

However obtain this: the area just needed $18,000 out of this residential property. The margin between the $18,000 they required and the $40,000 they obtained is referred to as "excess proceeds" (i.e., "tax obligation sales overage," "overbid," "surplus," etc). Lots of states have laws that ban the area from keeping the excess settlement for these homes.

The area has guidelines in area where these excess profits can be claimed by their rightful owner, generally for a designated duration (which varies from one state to another). And who precisely is the "rightful proprietor" of this cash? It's YOU. That's ideal! If you shed your home to tax foreclosure due to the fact that you owed taxesand if that property ultimately cost the tax sale auction for over this amountyou can probably go and gather the distinction.

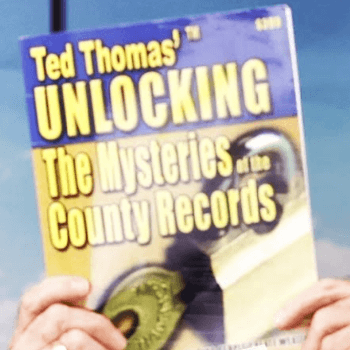

Optimized Tax Overages List Curriculum Bob Diamond Tax Overages Blueprint

This consists of proving you were the previous proprietor, finishing some documentation, and waiting for the funds to be supplied. For the average person that paid full market value for their property, this technique does not make much sense. If you have a severe quantity of money invested right into a home, there's means too a lot on the line to just "let it go" on the off-chance that you can bleed some added money out of it.

For instance, with the investing technique I use, I could purchase homes complimentary and clear for cents on the dollar. To the surprise of some capitalists, these deals are Thinking you understand where to look, it's honestly not hard to discover them. When you can purchase a home for a ridiculously affordable price AND you understand it's worth substantially more than you spent for it, it might effectively make sense for you to "roll the dice" and attempt to collect the excess profits that the tax repossession and public auction procedure generate.

Real Estate Overage Funds Tax Overage Recovery Strategies

While it can certainly work out comparable to the means I have actually described it above, there are additionally a couple of downsides to the excess earnings approach you really should understand. How to Recover Tax Sale Overages. While it depends substantially on the qualities of the home, it is (and sometimes, likely) that there will certainly be no excess profits generated at the tax obligation sale auction

Or perhaps the area doesn't create much public rate of interest in their auctions. Either means, if you're purchasing a building with the of letting it go to tax repossession so you can gather your excess earnings, what if that cash never ever comes via?

The first time I pursued this approach in my home state, I was told that I didn't have the option of claiming the excess funds that were created from the sale of my propertybecause my state really did not enable it (Foreclosure Overages). In states such as this, when they generate a tax sale overage at an auction, They just maintain it! If you're considering using this technique in your business, you'll desire to think long and tough regarding where you're operating and whether their regulations and statutes will also permit you to do it

Best States For Tax Overages Tax Foreclosure Overages

I did my ideal to provide the appropriate answer for each state over, however I would certainly advise that you before continuing with the presumption that I'm 100% right. Remember, I am not an attorney or a certified public accountant and I am not attempting to break down professional legal or tax obligation guidance. Speak to your lawyer or certified public accountant before you act on this info.

Table of Contents

Latest Posts

Tax Sale Property List

Tax Overages Course

Best Tax Lien Investing Course

More

Latest Posts

Tax Sale Property List

Tax Overages Course

Best Tax Lien Investing Course